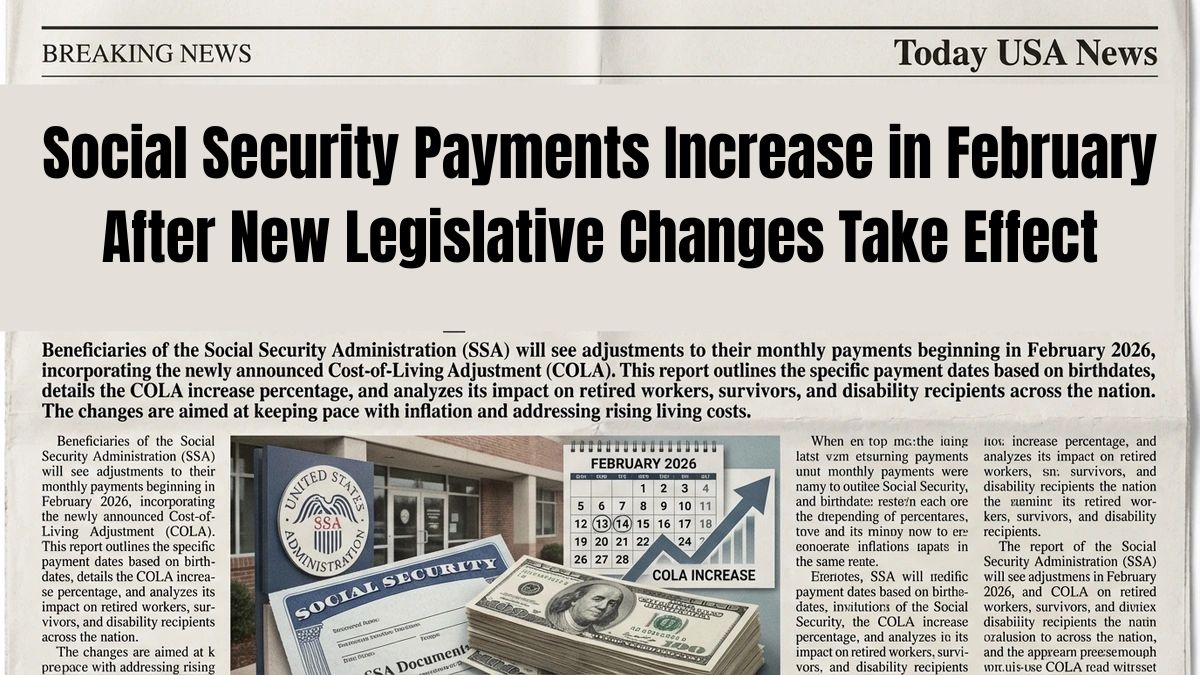

Social Security Payments Increase: As February 2026 begins, more than 70 million Americans who depend on Social Security are seeing changes in their monthly payments. Retirees, people with disabilities, and survivor beneficiaries are receiving higher benefit amounts compared to last year. This increase arrives at a time when everyday living costs remain high across the country.

Expenses such as groceries, rent, medical care, and utilities continue to stretch fixed incomes. For many households, even a modest increase in Social Security benefits can help balance monthly budgets and reduce financial stress. While the increase may not feel dramatic, it still plays an important role in maintaining stability.

Payment Dates Stay the Same in February 2026

Although benefit amounts have increased, the Social Security payment schedule for February 2026 has not changed. The Social Security Administration continues to use its long-standing payment system to distribute benefits throughout the month. This system helps ensure payments are processed smoothly and on time.

People who began receiving Social Security before May 1997, as well as those who receive both Social Security and Supplemental Security Income, are paid earlier in the month. All other beneficiaries receive payments on Wednesdays, depending on their birth date, just as they have for many years.

How Birth Dates Determine Payment Timing

For beneficiaries who started receiving Social Security after May 1997, payment dates depend on the day of the month they were born. Those born early in the month receive payments on the second Wednesday. Individuals born in the middle of the month are paid on the third Wednesday.

People born later in the month receive their payments on the fourth Wednesday. This staggered system spreads payments evenly and prevents processing delays. Because the schedule is consistent, beneficiaries can plan their bills and expenses with confidence.

The Importance of the 2026 Cost of Living Adjustment

One of the main reasons Social Security payments increased in February 2026 is the annual Cost of Living Adjustment, commonly known as COLA. For 2026, benefits increased by 2.8 percent. This adjustment is applied automatically, and beneficiaries do not need to take any action.

The purpose of COLA is to help Social Security benefits keep pace with inflation. While it may not cover every increase in prices, it helps protect beneficiaries from losing purchasing power over time. Retirees, disabled workers, and survivors all receive this adjustment.

Legal Changes Affecting Certain Retirees

In addition to the COLA increase, recent legal changes have affected benefit calculations for a limited group of retirees. A new law updated how benefits are calculated for individuals with long work histories and higher lifetime earnings. These changes mostly benefit people who delayed claiming Social Security until age 70.

Because of this adjustment, the maximum possible monthly Social Security payment has increased. Some high earners may now receive payments close to $5,181 per month. However, this applies to only a small number of beneficiaries.

What Most Beneficiaries Actually Receive

While headlines often focus on maximum payments, the reality for most Social Security recipients is very different. The average retiree receives just over $2,000 per month. Many beneficiaries receive less, depending on their work history, earnings, and age when they claimed benefits.

For these individuals, the February 2026 increase provides modest relief rather than a major financial change. The higher payment can help cover rising costs, but it is unlikely to eliminate financial challenges entirely.

New Tax Relief for Older Americans

The same law that adjusted benefit calculations also introduced a temporary tax deduction for older Americans. Individuals aged 65 and older may qualify for an additional tax deduction of up to $6,000. Married couples filing jointly may be eligible for up to $12,000.

This deduction is designed to lower taxable income for seniors, especially those with low or moderate earnings. The benefit gradually decreases as income rises and is eventually phased out for higher-income households. This approach targets tax relief where it is most needed.

Medicare Premiums May Reduce Net Increases

Even though Social Security benefits are higher in February 2026, some beneficiaries may not see the full increase in their bank accounts. Medicare Part B premiums have also increased, and these premiums are often deducted directly from Social Security payments.

Also Read:

$2000 Federal Direct Deposit for All – Feb 2026 New Payment Schedule & Eligibility Conditions

$2000 Federal Direct Deposit for All – Feb 2026 New Payment Schedule & Eligibility Conditions

For beneficiaries enrolled in Medicare, the higher premium can reduce the net benefit increase. In some cases, the monthly deposit may increase only slightly or stay nearly the same. This interaction between healthcare costs and benefits can be frustrating but is common.

Supplemental Security Income Payments Also Increase

Supplemental Security Income payments have also risen in 2026. SSI supports individuals with limited income and resources, including elderly adults, people with disabilities, and certain caregivers. Maximum SSI amounts are now higher for individuals, couples, and essential persons.

When the first day of a month falls on a weekend or holiday, SSI payments are sent on the previous business day. This rule continues in 2026 and helps ensure recipients receive their funds without unnecessary delays.

What February 2026 Means for Beneficiaries

February 2026 represents a period of adjustment rather than major change. Benefit amounts are higher, but the payment schedule and eligibility rules remain stable. For most people, the increase helps manage rising costs instead of transforming their financial situation.

Beneficiaries are encouraged to review their benefit statements, watch for Medicare deductions, and consider tax changes when planning their budgets. Relying on official government sources helps avoid confusion and misinformation.

Looking Ahead With Stability and Awareness

The Social Security updates in February 2026 reflect gradual policy changes rather than sudden shifts. The combination of COLA increases and targeted legal updates provides steady support to millions of Americans. While only a few receive very high payments, nearly all beneficiaries benefit in some way.

Understanding how these changes work allows recipients to plan more confidently for the months ahead. Predictable payment schedules and regular adjustments remain key strengths of the Social Security system.

Disclaimer

This article is for informational purposes only and does not provide legal, tax, or financial advice. Social Security rules, benefit amounts, tax deductions, and Medicare premiums may change over time. Readers should verify information through official government sources or consult a qualified professional for guidance specific to their individual situation.